” Digital Twin Financial Services and Insurance Market Global Digital Twin Financial Services and Insurance Market, By Type (System Digital Twin, Process Digital Twin, Product Digital Twin), Deployment (Cloud, On-Premises), Application (Bank Account Funds Checking, Digital Fund Transfer Checks, Policy Generation, Others), Technology (IOT and IIOT, Artificial Intelligence and Machine Learning, 5G, Big Data Analytics, Blockchain and Augmented Reality, Virtual Reality, Mixed Reality) – Industry Trends and Forecast to 2031.

Digital Twin Financial Services and Insurance Market Industry Trends and Forecast to 2031

What are the projected market size and growth rate of the Digital Twin Financial Services and Insurance Market?

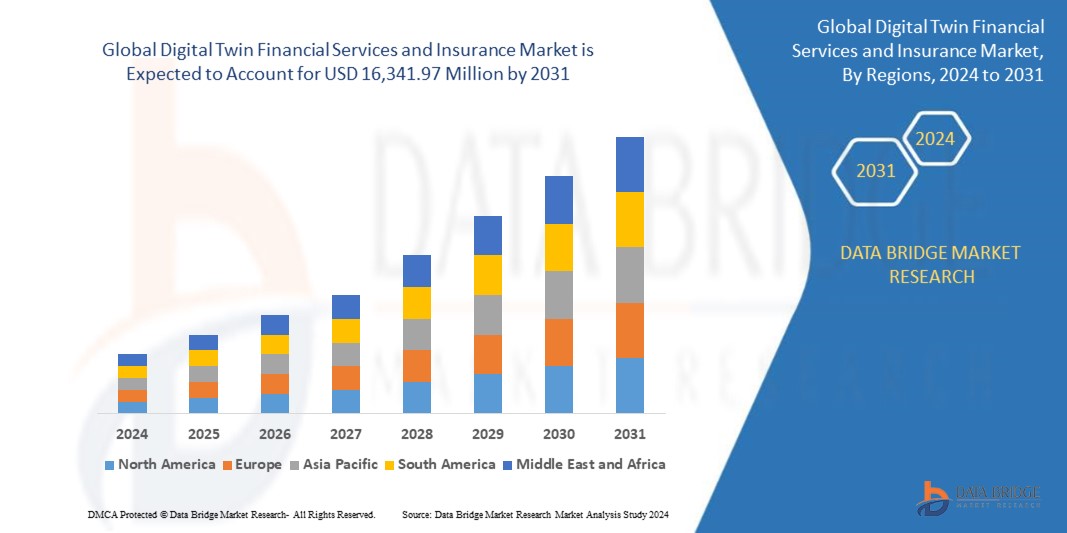

Data Bridge Market Research analyses that the Global Digital Twin Financial Services and Insurance Market which was USD 3.61 Million in 2021 is expected to reach USD 12.07 Billion by 2029 and is expected to undergo a CAGR of 16.30% during the forecast period of 2021 to 2029

Get a Sample PDF of Report – https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-twin-financial-services-and-insurance-market

Which are the top companies operating in the Digital Twin Financial Services and Insurance Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the Digital Twin Financial Services and Insurance Market extension. This Global Digital Twin Financial Services and Insurance Market report provides the information of the Top 10 Companies in Digital Twin Financial Services and Insurance Market in the market their business strategy, financial situation etc.

**Digital Twin Financial Services and Insurance Market 2024 Analysis:**

– The Digital Twin market in the Financial Services and Insurance sector is projected to witness significant growth in 2024. With increasing adoption of digital transformation strategies by financial institutions and insurance companies, the demand for digital twin technology is expected to rise. The ability of digital twins to provide real-time insights, analyze data, and optimize operational processes will drive their adoption across various segments within the industry. Additionally, advancements in IoT, AI, and cloud computing technologies will further propel the growth of the digital twin market in the financial services and insurance sector in 2024.

**2031 Market Analysis:**

– Looking ahead to 2031, the Digital Twin market in the Financial Services and Insurance industry is anticipated to experience substantial expansion. The increasing focus on enhancing customer experience, reducing operational costs, and mitigating risks will drive the adoption of digital twin solutions across the sector. Digital twins will play a crucial role in enabling predictive maintenance, personalized services, and risk assessment in real-time, leading to improved efficiency and profitability for financial institutions and insurance providers. As companies strive to remain competitive in a rapidly evolving digital landscape, the integration of digital twin technology will become indispensable.

**Market Players:**

– Some of the key players operating in the Global Digital Twin Financial Services and Insurance Market include:

– IBM Corporation

– Siemens AG

– PTC Inc.

– General Electric

– ANSYS

– Microsoft Corporation

– Oracle Corporation

– SAP SE

– Cisco Systems, Inc.

– Schneider Electric SE

– These companies are actively involved in product development, partnerships, and strategic collaborations to expand their market presence and offer innovative digital twin solutions tailored for the financial services and insurance industry. With a focus on enhancing digital capabilities, improving operational efficiency, and driving business growth, these market players are poised to shape the future of the digital twin market in the financial services and insurance sector.

https://www.databridgemarketresearch.com/reThe Digital Twin market in the Financial Services and Insurance sector is undergoing a transformative shift driven by the increasing complexity of operations, rising customer expectations, and the need for real-time decision-making capabilities. In 2024 and beyond, the integration of digital twin technology will play a pivotal role in reshaping the industry landscape. Financial institutions and insurance companies are increasingly recognizing the value of digital twins in enabling them to create virtual replicas of physical assets, processes, and systems. This simulation-based approach allows organizations to monitor, analyze, and optimize their operations in a more proactive and data-driven manner.

Furthermore, the convergence of digital twin technology with other cutting-edge innovations such as artificial intelligence, Internet of Things (IoT), and cloud computing is opening up new avenues for growth and innovation within the financial services and insurance sector. By leveraging these interconnected technologies, companies can extract actionable insights, automate workflows, and enhance the overall customer experience. Digital twins not only facilitate predictive maintenance and risk assessment but also enable personalized services and tailored product offerings that resonate with individual customer needs and preferences.

As we look towards 2031, the Digital Twin market in the Financial Services and Insurance industry is poised to witness accelerated expansion fueled by the increasing digitalization of processes, the growing emphasis on regulatory compliance, and the need for enhanced operational efficiency. The maturity of digital twin solutions coupled with advancements in data analytics and machine learning algorithms will enable organizations to achieve superior levels of operational transparency and agility. This will, in turn, enable them to streamline their workflows, optimize resource utilization, and drive continuous improvements in performance metrics.

The key market players in the Global Digital Twin Financial Services and Insurance Market are at the forefront of innovation, constantly pushing the boundaries of what is possible with digital twin technology. Through strategic partnerships, acquisitions, and R&D investments, these companies are striving to develop next-generation solutions that cater to the evolving needs of the market. By focusing on customer-centricity, technological excellence, and industry expertise, these players are positioning themselves as leaders in**Market Players:**

– General Electric (U.S.)

– IBM (U.S.)

– PTC (U.S.)

– Microsoft (U.S.)

– Siemens AG (Germany)

– ANSYS, Inc (U.S.)

– SAP SE (Germany)

– Oracle (U.S.)

– Robert Bosch GmbH (Germany)

– Swim.ai, Inc. (U.S.)

– Atos SE (France)

– ABB (Switzerland)

– KELLTON TECH (India)

– AVEVA Group plc (UK)

– DXC Technology Company (U.S.)

– Altair Engineering, Inc (U.S.)

– Hexaware Technologies Limited (India)

– Tata Consultancy Services Limited (India)

– Infosys Limited (Bengaluru)

– NTT DATA, Inc. (Japan)

– TIBCO Software Inc. (U.S.)

The Digital Twin market in the Financial Services and Insurance sector is undergoing a transformative shift driven by the increasing complexity of operations, rising customer expectations, and the need for real-time decision-making capabilities. In 2024 and beyond, the integration of digital twin technology will play a pivotal role in reshaping the industry landscape. Financial institutions and insurance companies are increasingly recognizing the value of digital twins in enabling them to create virtual replicas of physical assets, processes, and systems, allowing for more proactive and data-driven monitoring, analysis, and optimization of operations.

Furthermore, the convergence of digital twin technology with other cutting-edge innovations such as artificial intelligence, Internet

Explore Further Details about This Research Digital Twin Financial Services and Insurance Market Report https://www.databridgemarketresearch.com/reports/global-digital-twin-financial-services-and-insurance-market

Browse More Reports:

https://adwetad.blogspot.com/2024/08/asthma-disease-market-share-growth.html

https://adwetad.blogspot.com/2024/08/peptide-and-anticoagulant-drugs-market.html

https://strategicmarketresearch12.blogspot.com/2024/08/freight-forwarding-market-cagr-growth.html

https://strategicmarketresearch12.blogspot.com/2024/08/memory-foam-mattress-market-growth.html

https://strategicmarketresearch12.blogspot.com/2024/08/steel-fiber-market-growth-share-value.html

https://strategicmarketresearch12.blogspot.com/2024/08/coalescing-agent-market-revenue.html

https://strategicmarketresearch12.blogspot.com/2024/08/vegetable-concentrates-market.html

https://strategicmarketresearch12.blogspot.com/2024/08/ultrasound-probe-disinfection-market.html

https://strategicmarketresearch12.blogspot.com/2024/08/molecular-breeding-market-share-growth.html

https://strategicmarketresearch12.blogspot.com/2024/08/refrigerated-transport-market-growth.html

https://strategicmarketresearch12.blogspot.com/2024/08/medical-document-management-systems.html

https://strategicmarketresearch12.blogspot.com/2024/08/benzoic-acid-market-growth-share-value.html

https://strategicmarketresearch12.blogspot.com/2024/08/chlorohydroxypropyltrimethyammonium.html

https://strategicmarketresearch12.blogspot.com/2024/08/electrical-house-e-house-market-outlook.html

https://strategicmarketresearch12.blogspot.com/2024/08/cosmetic-antioxidants-market-growth.html

https://strategicmarketresearch12.blogspot.com/2024/08/cognitive-security-market-opportunities.html

https://strategicmarketresearch12.blogspot.com/2024/08/bone-metastasis-market-research-report.html

https://strategicmarketresearch12.blogspot.com/2024/08/automated-blood-tube-labeller-specimen.html

https://strategicmarketresearch12.blogspot.com/2024/08/intelligent-transport-system-market.html

https://strategicmarketresearch12.blogspot.com/2024/08/glass-insulation-market-growth-share.html

Data Bridge Market Research:

Today’s trends are a great way to predict future events!

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

“

No Responses